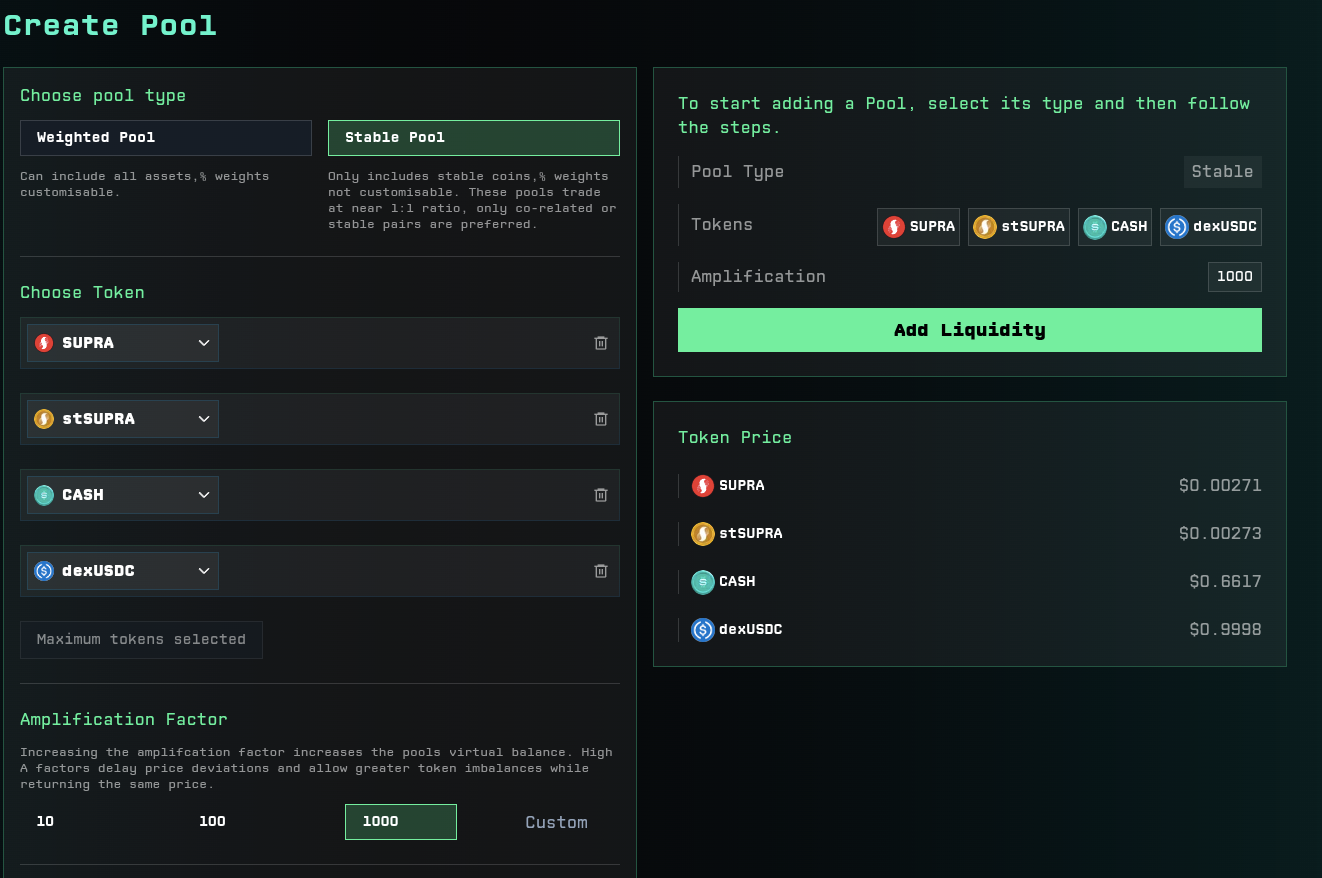

Stable Pools

Stable Pools are a sophisticated liquidity solution designed for assets that are expected to consistently swap at near parity or maintain a known exchange rate. Built on Stable Math (based on StableSwap, popularized by Curve), these pools enable swaps of significant size before encountering substantial price impact, vastly increasing capital efficiency for like-kind and correlated asset exchanges.

Unlike traditional AMM pools that are efficient for long-tail assets, Stable Pools are specifically optimized for tokens that converge on a value of "1" relative to each other, allowing for low-slippage, cost-effective trading.

Pool Specifications

| Property | Value |

|---|---|

| Max Tokens in Pool | 4 |

| Recommended Swap Fee | 0.01% - 0.05% |

| Pool Creation | Permissionless |

| Mathematical Model | Stable Math (StableSwap) |

Technical Constraints

Stable Pools operate under specific mathematical constraints due to the nature of Stable Math:

- Maximum tokens: 6 tokens per pool (due to computational complexity)

- Asset correlation: Assets should trade near parity or have predictable exchange rates

- Token decimals: All tokens must have decimals between 6 and 12 (inclusive) to prevent extreme precision multipliers that could cause calculation errors

- Amplification factor: Configurable parameter that affects price impact sensitivity

- Governance control: Amplification factor modifications require protocol governance approval

Ideal Use Cases

1. Pegged Tokens

Assets that maintain a near 1:1 value relationship, such as:

- Stablecoins of the same currency: iUSDC, iUSDT, dexUSDC

- Synthetic assets: Representing the same underlying asset (e.g., stSUPRA, iSUPRA)

- Wrapped tokens: Different versions of the same asset across chains

Benefits:

- Minimal slippage for large trades

- Efficient arbitrage opportunities

- Enhanced capital utilization

2. Correlated Tokens

Tokens with predictable exchange rates that change slowly over time:

- Yield-bearing tokens: iUSDC/supUSDC, iSupra/Supra

- Cross-chain wrapped assets: supUSDC and dexUSDC

Benefits:

- Accommodates gradual rate changes

- Maintains efficiency despite evolving ratios

Stable Math Foundation

Stable Pools use a sophisticated mathematical model that balances between constant product and constant sum curves, optimized for assets trading near parity.

The equation creates a curve that:

- Behaves like a constant sum (x + y = k) when assets are balanced

- Transitions to constant product (x * y = k) when assets become imbalanced

- Provides minimal slippage for trades near the peg

Amplification Factor (A)

The amplification factor is a critical parameter that determines how closely the Stable Pool curve resembles the constant sum curve versus the constant product curve.

Impact of Amplification Factor

Low Amplification Factor

- Behavior: Easier to move assets off peg

- Trade Impact: Higher slippage for large trades

- Recovery: More difficult for assets to return to peg

- Use Case: Assets with less stable correlations

High Amplification Factor

- Behavior: Maintains peg more strongly

- Trade Impact: Lower slippage for both small and large trades

- Recovery: Assets naturally return to peg

- Use Case: Highly correlated or pegged assets

Amplification Factor Management

- Initialization: Set by pool creator during deployment

- Modifications: Only possible through protocol governance

- Considerations: Balance between stability and fee generation

- Optimization: Consider existence of alternative markets

Key Advantages

1. Superior Capital Efficiency

Stable Pools dramatically improve capital efficiency compared to traditional AMMs for correlated assets:

- Reduced Slippage: Minimal price impact for large trades

- Better Utilization: More of the liquidity is actively used for trading

- Lower Costs: Reduced trading fees due to improved efficiency

2. Seamless Integration

Stable Pools integrate seamlessly with the broader Atmos ecosystem:

- Batch Swaps: Combine multiple swaps into gas-efficient transactions

- Arbitrage: Efficient cross-pool arbitrage opportunities

3. Enhanced Liquidity Strategies

Stablecoin Trading Hub

Configuration: iUSDC/iUSDT Stable Pool

Benefits:

- Low-slippage stablecoin swaps

- Arbitrage opportunities between different stablecoin markets

- Consolidated liquidity for USD-pegged assets

- Gas-efficient multi-hop swaps

Cross-Chain Asset Bridges

Configuration: supUSDC/dexUSDC Stable Pool

Benefits:

- Efficient swaps between different bridge implementations

- Reduced friction for cross-chain operations

- Consolidated liquidity for bridge assets

Best Practices

Pool Design Recommendations

-

Asset Selection:

- Choose assets with strong correlation or known pegs

- Verify long-term relationship stability

- Consider market depth and trading volume

-

Amplification Factor:

- Start conservative and adjust based on performance

- Monitor for optimal balance between stability and fees

- Consider governance timeline for adjustments

-

Liquidity Provision:

- Maintain balanced deposits to optimize efficiency

- Monitor for impermanent loss despite reduced risk

- Consider yield farming opportunities

Risk Considerations

- Depeg Risk: Assets may lose their correlation or peg

- Amplification Risk: Incorrect A factor can reduce efficiency

- Liquidity Risk: Concentrated positions in fewer assets

Integration Benefits

Atmos Ecosystem Advantages

By integrating Stable Pools into the Atmos platform:

- Enhanced Trading Experience: Low-slippage swaps for correlated assets

- Improved Capital Efficiency: Better liquidity utilization across the platform

- Expanded Asset Support: Broader range of tradeable asset pairs

- Reduced Fragmentation: Consolidated liquidity in logical groupings

- Gas Optimization: Batch swaps and composable operations

Protocol-Level Benefits

- Deeper Liquidity: Concentrated in high-efficiency pools

- Better Price Discovery: More accurate pricing for correlated assets

- Increased Fee Generation: Higher volume due to improved efficiency

- Platform Differentiation: Advanced AMM capabilities

Conclusion

Stable Pools represent a crucial evolution in AMM technology, specifically designed to handle the unique requirements of correlated and pegged assets. By leveraging Stable Math and configurable amplification factors, these pools provide:

- Unmatched efficiency for like-kind asset swaps

- Flexible parameter tuning for different correlation strengths

- Seamless integration with broader DeFi ecosystems

- Enhanced capital utilization compared to traditional AMMs

Whether you're trading stablecoins, managing liquid staking positions, or bridging cross-chain assets, Stable Pools provide the specialized infrastructure needed for efficient, low-slippage operations in the modern DeFi landscape.